The dysfunctionalities of the electricity market were called into question to explain the market price increases in the Day Ahead Market of OPCOM (DAM). The minister of Energy pointed to the abnormally high market share that the DAM has in the total market transactions. “It is for the first time in a secondary market that we have almost 45% of the amount of energy consumed traded on the DAM. I understand that’s where problem comes from”, said Toma Petcu, on Friday, in a press conference.

An analysis of the data provided by OPCOM shows that:

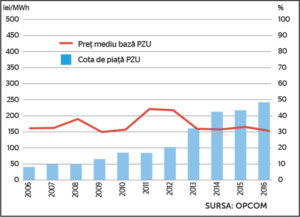

In the last ten years, the share of DAM in the total electricity transactions on the centralized market has grown steadily, from 7.88% (2006) to 47.01% (2016). In the same interval, average DAM prices fluctuated close to 150 lei per MWh, with a maximum of 188 lei in 2008, and over 200 lei in 2011 and 2012.

In the last ten years, the share of DAM in the total electricity transactions on the centralized market has grown steadily, from 7.88% (2006) to 47.01% (2016). In the same interval, average DAM prices fluctuated close to 150 lei per MWh, with a maximum of 188 lei in 2008, and over 200 lei in 2011 and 2012.- On a monthly basis, the highest market share for the DAM was recorded in April 2017 – 52.58%. The last month for which we have data indicates a 39.34% share for the DAM, the smallest since October 2015.

- In the last 18 months, the DAM had a market share of over 45% for 11 times. We can conclude that this “abnormally high” quota is the normal situation on the electricity market in Romania, at its current level of development!

- The months when DAM had the highest shares are different from those with the highest spot prices, in the last 18 months. This suggests that the high share of the DAM is not the only element and probably not the decisive factor in achieving high and increased prices on the Day Ahead Market.

In 30 months (January 2015 – June 2017), the correlation between the maximum DAM prices and the maximum DAM shares is extremely low (only two occurrences). A stronger correlation is that between the high DAM prices and the seasonality in demand: the highest 5 average monthly prices each year were recorded in winter or summer. With one or two exceptions each year, the DAM monthly market shares reached peak levels in different months.

In 30 months (January 2015 – June 2017), the correlation between the maximum DAM prices and the maximum DAM shares is extremely low (only two occurrences). A stronger correlation is that between the high DAM prices and the seasonality in demand: the highest 5 average monthly prices each year were recorded in winter or summer. With one or two exceptions each year, the DAM monthly market shares reached peak levels in different months.

However, experts and decision-makers continue to identify the high share of the DAM as one of the culprits for the high electricity prices. Moreover, the phenomenon has been aknowledged for a long time, and in January 2017 the Association of Electricity Suppliers from Romania (AFEER) explicitly listed the reasons for distortions in electricity transactions and summarized: the wholesale market is insufficiently flexible. “From our point of view, the retail market is the most competitive area in the Romanian economy. It is a competitive, solid market”, said Ion Lungu, president of AFEER. “At the same time, on the wholesale energy market, all traded products are standardized, which has encouraged the suppliers to switch to the spot market (DAM) and on the balancing market (PE), two markets that have recorded very high volumes of trading in the last period.”

The interest traders and suppliers showed for the DAM is therefore encouraged by the lack of flexibility of the wholesale market. In the short term, AFEER has been urging since January “to reintroduce the flexible agreements on PCCB-LE,” which “should lead immediately to a visible optimization of the wholesale market”. The suppliers also proposed:

- The reintroduction of directly negotiated bilateral agreements, which will also solve the problem of flexibility. ANRE seems to be open to this idea, but a legislative initiative is needed, and this is a difficult to sustain from a political perspective as the general public is still traumatized after the “smart boys” period.

- Reassessing the system of bank guarantees required for trading, in order to preserve and strengthen the trading discipline. While preserving confidentiality, a solution must be identified to guarantee the good execution, to ensure that there are no players with open positions, that exceed their financial capacity.

- The reassessment of the PCSU agreements, which must include more clear trading conditions and penalties. On June 8th, ANRE suspended the organization of simultaneous auction sessions with a declining price on the centralized market for the universal service, precisely for revisiting the trading conditions. One of the effects was that the suppliers of last resort (Electrica, ENEL, CEZ, E.ON) went to purchase electricity, including from the DAM, with volumes that we do not know, but which may have also contributed to the increase of prices in the spot market. Minister Toma Petcu announced that ANRE will resume the auctions on PCSU as of August 10th, when it is possible that the demand on the DAM will decrease. Update ANRE said on Monday that the resumption of the auction sessions and the preparation of the PCSU auction for the LRS’s purchase of the necessary energy for the customers will begin on 11 August 2017. The auction will take place in the second part of September, with the supply of energy at the new CPCs of the fourth quarter of 2017 to start on October 1, 2017.

The increase in electricity prices on the OPCOM Day Ahead Market is caused by a considerable number of factors. One is the meteorological conjuncture and how this impacts upon demand; in winter, extreme cold perioads contribute to increased electricity demand for heating, while in the summer, the heat is also causing an increase in the demand for air conditioning. Other factors include electricity exports or commercial practices and production policies from the large generation companies (CE Oltenia, Hidroelectrica), the contribution of the nuclear and the hydrocarbon sector, influenced by technical failures or planned interruptions for maintenance operations, as well as the contribution of the weather-dependent capacities based on wind and sun. In their turn, the renewable producers are pointing to the operating framework: “It is about regulations. The green energy producers, instead of lowering prices, they actually put pressure on prices because regulations force them to buy energy, so they can provide balance, when the wind does not blow or when there is no sun”, said Martin Moise, vice-president of PATRES.

The week starts with decreasing prices on the DAM

The share of the DAM in total transactions is too high to give a fair market signal and to provide a benchmark price for the decisions of those directly involved (producers, traders, suppliers and consumers, regulators or analysts). Including from this perspective, the interest shown towards the maximums reached on this market segment seems disproportionate. For example, the average price on the DAM for August 8th dropped at 233.92 lei per MWh, from 333.57 lei per MWh on August 7th, and the maximum levels varied in the same direction: 287.80 lei per MWh for August 8th, compared to 482.94 lei per MWh on August 7th.

For sure, some measures are necessary for increased flexibility of the wholesale market, which would improve the functioning of the electricity market. However, to focus strictly on the share of the DAM in the total electricity transactions, risks not to solve the issue of the increasing prices. We need an extended analysis of the elements that influence electricity prices – a no brainer, I admit! And I will conclude with a secret which everyone knows: structure of the generation mix, flattening of the load curve and balancing reserves must be the areas of interest and fields for action in order to have buth energy security, but also a chance for affordable price increases in the future. (See also our article Electricity prices are rising, let’s get used to this!)