The National Energy Regulatory Authority – ANRE has decided to annul, starting with November 19, the Regulation for the organization and functioning of the intraday electricity market. From the same date, the economic operators in the electricity sector and OPCOM – the operator of the Romanian electricity exchange, will operate according to the rules established by the European ACER regulator and implemented within the LIP 15 – Local Implementation Project.

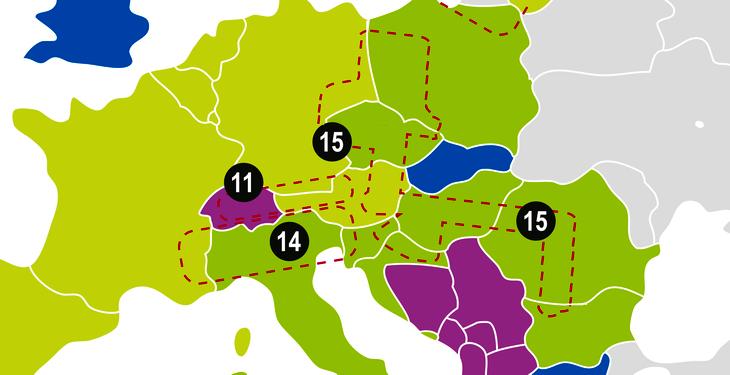

The TSOs and the operators of the designated electricity markets in Austria, Bulgaria, Czech Republic, Croatia, Germany, Poland, Romania, Slovenia and Hungary have agreed to establish a project for the local implementation of the solution for the cross-border intraday market (XBID) for coupling of intraday electricity markets. It was thus decided to introduce the implicit allocation of cross-border transport capacities on the Czech Republic-Germany, Czech Republic-Austria, Austria-Hungary, Hungary-Romania and Hungary-Croatia borders. The Parties have established a Local Implementation Project (called LIP 15) aimed at meeting the requirements set by the XBID project on the cross-border intra-EU market at EU level.

The XBID project for pan-European coupling of intraday markets is made up of members from 14 European countries. The purpose of the XBID Cross-border Intra-Market Market Project is to enable continuous cross-border trading and to increase the overall efficiency of intra-day trading on the cross-border intra-European market. This single intraday cross-zonal market solution will be based on a common IT system forming the backbone of the European solution, linking the local trading systems operated by the Power Exchanges as well as the available cross-zonal transmission capacity provided by the TSOs. Bids and offers submitted by market participants in one country can be matched by those submitted by market participants in any other country within the IT systems’ reach, provided there is cross-zonal capacity available.

The approach is expected to increase the liquidity of the newly coupled intraday continuous markets, since orders submitted for the purpose will be potentially matched with orders submitted in any other participating country. In other words orders that could not be matched in local markets increase their probability of being matched in the larger integrated market. In addition, the solution facilitates the operational tasks of intraday cross-border scheduling, since the capacity allocation and energy matching processes is done simultaneously. As a consequence, market efficiency is also expected to increase, to the benefit of the market participant.

The direct benefit for the end consumer is expected to be positive, and the end consumers will benefit from this initiative increasing the overall wholesale market efficiency and facilitate the integration of the RES in the market. More concretely market participants having larger possibilities to be balanced before the hour of delivery will contribute to reduce the costs of reserves.