Earlier this month, the European Commission published on its website the updated draft version of the Romanian National Energy and Climate Plan (NECP), with the final form of the updated plan to be delivered to the Commission by June 30, 2024. Here are some comments from Julia Szabo, senior analyst at Aurora Energy Research, one of the largest dedicated power analytics providers in Europe.

The plan is supposed to outline how Romania intends to address the five dimensions of the EU’s Energy Union strategy: decarbonization, energy efficiency, energy security, the internal energy market, research, innovation, and competitiveness. However, a prerequisite for the ratification of this plan is approving an energy strategy, something Romania has not yet done. There have been several attempts from 2016 until now; the strategy is expected in early 2024, notes Julia Szabo.

Increased ambitions on RES

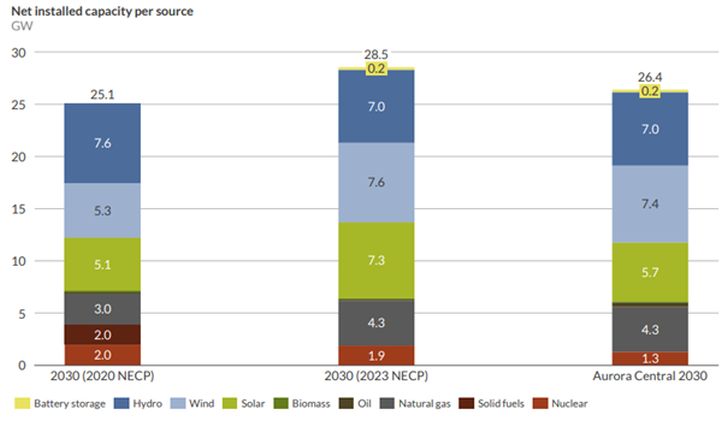

The 2020 version of the Romanian NECP was criticized for lacking ambition. The overall renewable energy contribution is significantly below the total consumption’s renewable share of at least 34% in 2030. According to the NECP, 30.7% of the total consumption should be covered by renewables by 2030. The NECP expects 5.1 GW of installed solar capacity (a 2.3 GW increase compared to the current level) and 5.3 GW of onshore wind capacity (a 3.6 GW increase from today’s level) by 2030. The government outlined plans to encourage the buildout of RES capacities based on market rules and CfD auctions, although no concrete plan was outlined at the time. One extra nuclear reactor (650 MW) is also shown in the NECP’s 2030 capacity.

According to the 2023 revised draft NECP (in Romanian), 36% of the total consumption should be covered by renewables by 2030.

The new NECP is significantly more ambitious than the previous NECP, with targets for 3.2 GW more solar (43% more, 7.3 GW in total) and 2.3 GW more wind (44% more, 7.6 GW in total) by 2030.

Scepticism on the 2025 targets

The 2025 targets project a rapid trajectory of renewable capacity installation. However, given the deployment in the last few years and the slow licencing of projects, reaching the 2025 target is rather unlikely, as it would mean that 2.5 GW of solar capacity and 2 GW of wind need to be installed in 2 years. Given the current legislative environment, slow, untransparent licencing, and limited potential profit of RES projects because of taxes, merchant RES projects are not attractive. In respect to the PPAs, that might accelerate the deployment; however, the market is immature and there are several obstacles to face.

The targets would be easier to reach via support mechanisms; however, Romania’s announced CfD auctions are unlikely to bring capacity online by 2025. It is split into two auctions: the first auction in 2023 for 2 GW, and the second auction in 2025 for 3 GW. However, the first auction, set to bring 2 GW online (1 GW wind and 1 GW solar) by 2026 and announced to happen in 2023, is delayed and unlikely to be completed within the year.

For the aforementioned reasons, Aurora’s central market view expects a slower development of RES capacities in the following years.

More feasible targets for 2030

The 2030 targets are ambitious but more feasible: Romania targets 7.3 GW solar (from 1.3 GW) and 7.6 GW wind (from 3.0 GW). The wind capacity targets are in line with Aurora’s projection; solar is more than 1 GW higher. These could be reached if new subsidy mechanisms are in place besides the planned 5 GW CfD scheme. Otherwise, to make renewable projects more attractive without subsidies, via PPAs, or on a merchant basis, the transparency of the legislative environment needs to be improved.

The plan introduces innovative concepts like agrisolar parks, which hold significant potential for Romania. Unfortunately, the plan lacks detailed descriptions of these innovations, leaving stakeholders seeking more clarity on how they contribute to the country’s renewable energy landscape.

Additionally, Romania sets a target of at least 240 MW or 480 MWh of battery storage by 2025. Recognising the pivotal role of batteries and hydrogen in ensuring grid stability, the goal of 240 MW is considered realistic, even without extensive governmental support.

Some question marks on nuclear and gas projects

By 2030, the objective of Romania is to construct 462 MW of new installed SMR (small modular reactors) capacity and 2.6 GW of natural gas-powered CCGTs.

The US aims to deploy Europe’s first American-made small modular nuclear reactors (SMR) in Romania and Czechia by 2029 as part of “Project Phoenix.” This broader initiative seeks to replace coal-fired power plants in central and eastern Europe with small modular reactors. Aurora’s analysis suggests that new nuclear power at a considerable scale —over 100 MW of new capacity — may not be feasible without continuous and significant government support. “Currently, the desired support is not yet there, and therefore, in our analysis, we don’t assume nuclear capacity growth. This may be revisited in case tangible support schemes are in place.”

Concerning natural gas, the proposal expects 2.6 GW of new gas-fired combined cycle turbines (CCGT). Anticipatedly low margins, with full load hours dropping below 1000 h/year by 2043, could lead to collapsing wholesale gross margins. The profitability of CCGTs hinges on potential capacity market support and additional revenues from the ancillary services markets. In the long term, some CCGTs may convert to hydrogen, impacting full load hours.

Overall assessment

There are undoubtedly some detailed and forward-looking elements of the draft, considers Julia Szabo, from Aurora Energy Research. However, it is also clear that a lot of work is still needed to produce the final version by June 2024. The list of measures should be improved in both quantity and quality in the final version to reach the 2030 targets.