The last few years have been marked by radical transformations in global energy markets, following disruptions caused by the COVID-19 pandemic, the Russian Federation’s aggression against Ukraine and the exacerbation of the climate crisis, all of which have profoundly affected supply chains, resulting in a surge in prices. In this new geopolitical and geo-economic context at European level there has been a strategic reorientation, manifested by the large-scale adoption of renewable energy sources (RES).

The last few years have been marked by radical transformations in global energy markets, following disruptions caused by the COVID-19 pandemic, the Russian Federation’s aggression against Ukraine and the exacerbation of the climate crisis, all of which have profoundly affected supply chains, resulting in a surge in prices. In this new geopolitical and geo-economic context at European level there has been a strategic reorientation, manifested by the large-scale adoption of renewable energy sources (RES).

In order to eliminate dependence on fuel imports from third countries, the European Union (EU) has set an ambitious target for 2030 – that 42.5% of energy should come from RES, aiming for the complete decarbonization of the economy by 2050. Solar photovoltaics play a key role in achieving these targets due to their versatility and low cost. However, while the rate of installations is growing substantially year-on-year in Europe, the supply chain of technologies, equipment and components is concentrated in one geographical location – the Asia-Pacific region. As a result, in response to developments in the international system and taking into account the impact that exogenous phenomena such as pandemics and wars have on the availability of technologies, initiatives have been taken at EU level to reindustrialize and bring PV-related manufacturing back to Europe.

Current state of production of PV equipment and technologies

The energy crisis has undeniably stimulated the rapid expansion of the PV sector, globally, regionally and nationally. In Europe, installed capacity has increased by 91% in the last three years, from 136 GW in 2020 to 259.99 GW in 2023 [Solar energy (europa.eu)]. However, while globally demand is on an upward slope, the same cannot be said for the development of supply chains, which continue to be concentrated in the Asia-Pacific region.

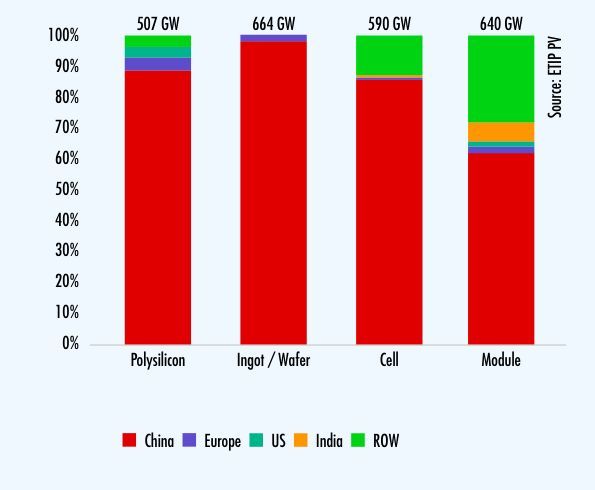

The focus is on the use of crystalline silicon (c-Si) modules, which account for more than 98% of global production. Another technology used, albeit to a much lesser extent, is cadmium telluride (CdTe), which accounts for the remaining 2% (ETIP PV, 2023 – PV Manufacturing in Europe: understanding the value chain for a successful industrial policy). In terms of the production of polysilicon, the raw material for photovoltaic panels, China is the global leader (89%), followed by South Korea, the US and the EU. A similar situation is found for ingot and wafer manufacturing (97%), where production capacity is concentrated exclusively in the Asia-Pacific region. Similar statistics are observed in terms of module production, where, although there are assembly facilities in over 38 countries, China manufactures about 70% of the global total, followed by Vietnam, Malaysia, Korea and Thailand [IEA, 2022. Special Report on Solar PV Global Supply Chains: Special Report on Solar PV Global Supply Chains (windows.net)].

The Asia-Pacific region’s geographic dominance of the PV supply chain is the result of China’s policies over the past 15 years, coupled with more than 50 billion euros in investments [IEA, 2022. Special Report on Solar PV Global Supply Chains: Special Report on Solar PV Global Supply Chains (windows.net)], which have led to the country consolidating its position as a global leader in technology and component exports and monopolizing market share at every stage of the production process.

The rise of China’s PV industry has profoundly reshaped the global manufacturing landscape for the components and equipment needed to capitalize on solar energy, evidenced both by the falling price of PV modules, which in 2023 reached a low point of 0.129 euros/Wp, and by the increasing use of this technology worldwide. However, while the policies and strategies undertaken by the Beijing regime have contributed to lowering costs in the sector, increasing the attractiveness and profitability of the PV industry, developments in the geopolitical context and vulnerabilities in global supply chains, revealed by the COVID-19 pandemic, have led to the emergence of geographic concentration as a potential challenge.

Against the backdrop of the energy crisis, ensuring the availability of photovoltaic technology has become a topic of strategic importance for the EU, which has taken the form of discussions on relocating production as part of the so-called “reshoring” process, with a view to bringing productive activities back to the European continent.

Creating a competitive solar PV supply chain in Europe

As part of the objective to achieve a 42.5% share of RES-E, the EU aims to install 750 GWdc (600 GWac) of solar PV by 2030. To this end, in order to support investment in the sector, but also to strengthen strategic autonomy, the Commission launched in December 2022 the Industrial Solar Alliance to create an autonomous and resilient European supply chain. In terms of manufacturing capacity development, the target for 2025 is 30 GW, supported by boosting EU manufacturing of modules, ingots, wafers and related technologies to meet internal and external market requirements. It also aims to diversify the components of the international PV value chain and the necessary raw materials through research and innovation [European Solar Photovoltaic Industry Alliance – European Commission (europa.eu)].

Although we cannot speak, at the moment, of a well-defined industry in terms of production, it is important to note that 166 companies are active in this field in Europe, producing annually 14.1 GW of modules, 2 GW of cells, 81.1 GW of inverters, 26.1 GW of polysilicon (SolarPower Europe, 2024. EU Solar Manufacturing Map: EU Solar Manufacturing Map – SolarPower Europe). On the positive side, value chains in this sector are characterized by dynamism and adaptability to new investments, giving them a competitive advantage in the global market. As a result, in recent years, several European companies have started to step up their activities or implement expansion plans. One of the most ambitious projects in the EU aims to commission a 3 GW production capacity that will combine crystalline silicon with other semiconductor materials, with the ultimate goal of increasing cell efficiency and pushing the limits of current photovoltaic technology. The project is part of a global trend of innovation in the sector, seen in other companies, which in early 2024 set a new record for the world’s most efficient panel, with a conversion rate of 25%, four percentage points higher than widely used technology, marking a crucial milestone in the energy transition.

However, while the sector has significant opportunities for growth, a key factor in expanding and developing supply chains is building an ecosystem that supports and stimulates the necessary investment, for which the input of each member state is crucial.

Developing supply chains – impact on Romania

While timid trends in the development of a value chain in Romania have been observed since 2010-2014, none of the 166 European companies producing various components and technologies necessary for the photovoltaic industry are based or operate in Romania, which is an economic and strategic disadvantage.

In a positive development, after this lull that lasted for about a decade, a new investment cycle in PV panel production is taking shape. From 2023, several ambitious projects have been announced, including the construction of plants with a total capacity of 10.3 GW. Compared to the previous period, the development of the value chain is supported this time by a series of funding calls through the National Recovery and Resilience Plan (NRRP) amounting to 199,000,000 euros, dedicated to the construction of new polysilicon and wafer production, cell and panel assembly capacities totaling 200 MW, complemented by support for investments in related technologies such as batteries.

While the discussion on supply chains focuses on the production dimension, it is necessary to consider the end-of-life of these technologies. Recycling of panels is key to creating a resilient and sustainable value chain, particularly as the process can recover key raw materials in manufacturing processes. In this respect, the Romanian Photovoltaic Industry Association (RPIA) is actively contributing to the development of the segment, as part of a consortium of 16 entities, whose one project funded by the Horizon Europe program aims to identify innovative processes by which 99% of panels can be reintegrated into a new production cycle (Grant Agreement no. 101122332).

In addition to contributing to strategic autonomy and energy security, the development of supply chains in Romania also has social benefits due to job creation in the production, construction and operation of new facilities. From an economic point of view, every euro invested increases production by 1.3 euros and, considering the projects announced, their realization would bring millions of euros in contributions to the budget (Deloitte&E3M – Renewable Energy in Romania – Roadmap to 2030 – report for RWEA&RPIA).

Materializing investments in the development of PV industry supply chains involves both the creation of an attractive ecosystem and a strategic approach, based on clear and transparent policy documents, where Romania has considerable gaps. At present, there is no comprehensive national vision adapted to the context in terms of industrial policy, providing a concrete direction for action. As a result, there is a need to increase the transparency of decision-making, stimulate innovation and investment at local level, by creating a stable and predictable framework that will increase the attractiveness of the Romanian market.