UPDATE

Small investors have subscribed 14,5 million shares in Nuclearelectrica’s IPO until Friday, September 13 , at 18.00. They offered almost 218 million lei (more than 48.5 million euros), according to brokers, Agerpres said.

ORIGINAL TEXT

The volume of Nuclearelectrica shares small investors asked for until Wednesday exceeded five times the available allocation. Small investors were attracted by the discount of 8% applied during the first three days of the public offering. Amounts paid after orders weere placed in this segment amounted to 203.8 million lei (45.6 million).

Since the segment dedicated to small investors is oversubscribed by more than 5.3 times, investors will take possession of shares in inverse proportion to the degree of oversubscription. For exemple, if an investor wants to buy 100 shares, and during the trading there were requests exceeding 5 times the available supply, that investor will get 20 shares, representing the 5th part of the 100 shares he has asked for.

In a previous posting, energynomics.ro showed that Nuclearelectrica listing on the stock exchange will happen only if the all shares will be subscribed. The IPO documentation created by the consortium consisting of Swiss Capital and BT Securities stated that

Razvan Paşol, President and CEO of Intercapital Invest, told energynomics.ro the small investors interest on Nuclearelectrica’s shares may be enough to prevent the failure of the IPO. If the shares allocated to the institutional investors are not traded, the shares will be reallocated to the remaining segments where there is over-subscription. Thre precise reallocation will proceed according to a procedure established by the listing brokerage consortium.

So far orders placed by retail investors are modest, and the offers from institutional investors will be made public not until the conclusion of IPO. Therefore, in case of maintaining a modest participation from retail investors, cummulated with a poor participation from institutional investors, the small investors’ enthusiasm can save Nuclearelectrica IPO.

As part of the so called small subscription tranche, investors may subscribe for 10% of the 25.4 million shares subject to the IPO that started on Monday. They also benefit from a 8.0% discount from the price for institutional investors in case they subscribe in the first three days. This price varies between 11.2 lei ($3.3/2.5 euro) and 15 lei per share and is to be determined after the subscription period ends on September 20.

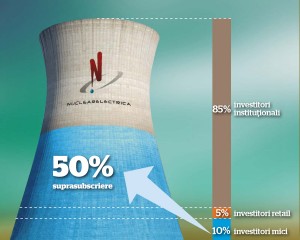

The IPO is split into three tranches: 85% of the shares are allocated to institutional investors, where a minimum of 15,001 offered shares need to be subscribed; an retail investors tranche with a minimum subscription of 15,000 shares (5%); and 10% of subscriptions are available to small investors ( between 100 and 15,000 shares).