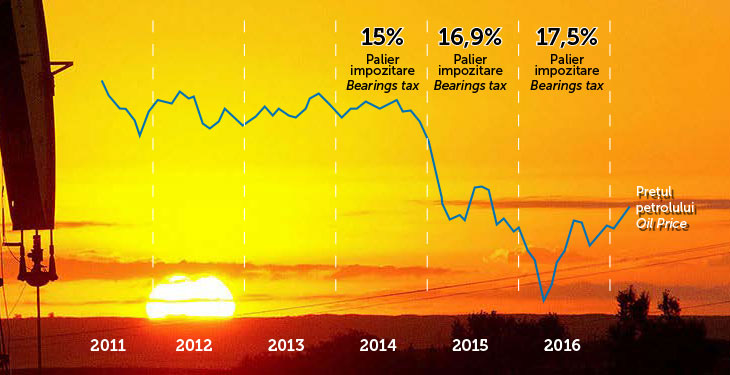

The average effective rate of the royalties and other taxes imposed on the oil and gas industry in Romania has increased from 15% in 2014, to 16.9% in 2015 and 17.5% in 2016, while in most European states it decreased. The trend observed by the experts at Deloitte manifested within an interval in which the international crude oil price dropped from about 100 dollars per barrel (in 2014) at a minimum of 30 dollars per barrel, in 2016, to return at present close to 50 dollars.

The Deloitte study “An Overview upon royalties and similar taxes. The upstream oil and gas sector in Europe” is considering effective tax rates from different European countries. In Romania’s case, royalties and other forms of taxation, such as the tax on additional income resulting from the liberalization of the natural gas prices, the special construction tax, the tax upon the revenue resulted from the exploitation of crude oil, were included.

The main findings of the study are:

- The effective average rate of royalties and other similar taxes (an additional tax for natural gas, the special construction tax, the tax upon the revenues from the exploitation of crude oil) increased from 15% in Romania in 2014, at 15,7% in the first half of 2015, and at 16,9% at the end of 2015, reaching 17,5% in 2016.

- The effective average rate of royalties and other similar taxes decreased in Europe (including at the Groeningen deposit in Holland, which has a special tax regime), from 11,7% in 2014, at 10% in 2015.

- The effective average of royalties and other similar taxes decreased in Europe (excluding the Groeningen deposit in Holland) from 9,3% in 2014, at 7,9% in 2015.

- The effective average of royalties and other similar taxes was down in 2015 compared with 2014 in 10 European countries: U.K., Norway, Denmark, Hungary, Austria, Germany, Holland, Italy, Bulgaria and Albania.

- The effective average of royalties and other similar taxes recorded a slight increase in the period under analysis in five European countries: Serbia, Lithuania, Ireland, France and Poland.

- The effective tax rate for the upstream natural gas activity in Romania has a value much higher than the one for the exploration and production activities of oil, the difference resulting mainly from the additional tax applied to the natural gas.

The study continues the Deloitte analyzes on the same topic, published in 2015, taking into account the limitations imposed by the different tax regime applicable in each country, but also effective tax rates existing in different European countries, based on the publicly available information on December 31st, 2015. Thus, the effective tax rate for each country was calculated by dividing the value of the royalties and of the specific fees and taxes paid by the major industry players to the revenues obtained from the production and sale of oil and natural gas.

In this regard, the actual royalties and other similar specific taxes may differ from the nominal rates, being influenced by the national priorities, market realities and the recent strong decline in oil and gas prices, which is affecting the industry in recent years.