Ebury came in the Romanian market two years ago, operating international money transfers and FOREX risk management. Now they are preparing to start launching lending services, Johan Gabriels, CEO of Ebury for Romania & Bulgaria, told at EnergynomicsTalks.

Ebury is majority owned by Santander, one of the largest financial institutions, with a market capitalization of about 75 billion USD at the beginning of this year (it dropped during crisis, but estimated to grow afterwards), now standing at 32 billion USD, about three times higher than Societe Generale’s (at 11 billion today) or four times bigger than Erste Group’s (as of today standing at about 8 billion USD), which own some of the largest foreign banks in Romania from the net assets perspective.Now, the markets try to reshape after crisis, hit by devaluation and volatility.

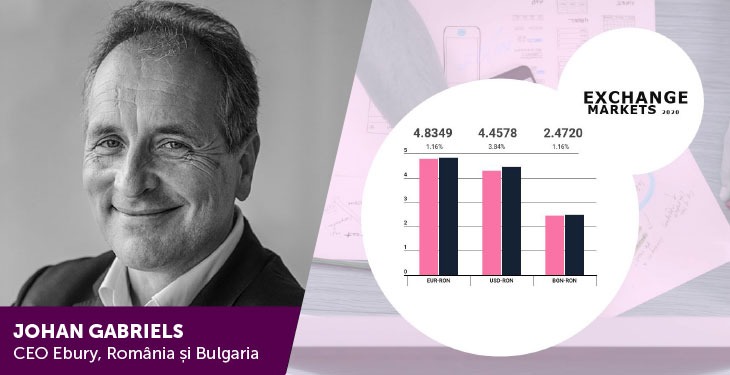

“A lot happened in the market during the crisis, there has been a lot of volatility, financial institutions reacted normally, by de-risking their balance sheets, focusing on cash flow, making sure that capital levels are up to date. There were a lot of changes in the markets, and in Eastern Europe, in Romania, we have seen a lot of volatility – less on the RON, but if you look at Poland, Hungary, The Czech Republic, there was something between 8 to 11% devaluation against the euro, at a certain point, which was a major impact. I think Romania succeeded in controlling that, having a different [currency] regime. [There was)] volatility, at a certain point even a shortage of liquidity in some currencies, which actually readdresses the importance of protecting yourelf against currency volatility, as a business,” Gabriels said.

He added that National Bank of Romania “did a good job” by keeping the leu protected, the devaluation of the past 10 years being of just 1.2% annually. “It is not the case in countries like Hungary and Poland, where you have a free floating regime.

Leu lost only 1% against the euro in the past two-three months, and it was even strengthening over the past couple of weeks, after the central bank’s interventions. “I think is a good thing, they keep their promises from that perspective.”

Gabriels went on to say that the impact of the crisis on GDP, although difficult to estimate now, will range between a drop of 4 to 6%, while the budget deficit will deepen to reach 7-8% of GDP.

Under these conditions, Ebury continues offering support to its clients. “We’re in this together, and we’re here to help”, Gabriels said, explaining that the crisis affected supply chains everywhere, and that could be a good opportunity for Romania to open up new shops for the large manufacturers fleeing regions such as China.